This is a new report by the Internation Energy Agency. Here is a small excerpt:

In the transition to clean energy, critical minerals bring new challenges to energy security

An energy system powered by clean energy technologies differs profoundly from one fuelled by traditional hydrocarbon resources. Solar photovoltaic (PV) plants, wind farms and electric vehicles (EVs) generally require more minerals to build than their fossil fuel-based counterparts. A typical electric car requires six times the mineral inputs of a conventional car and an onshore wind plant requires nine times more mineral resources than a gas-fired plant. Since 2010 the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as the share of renewables in new investment has risen.

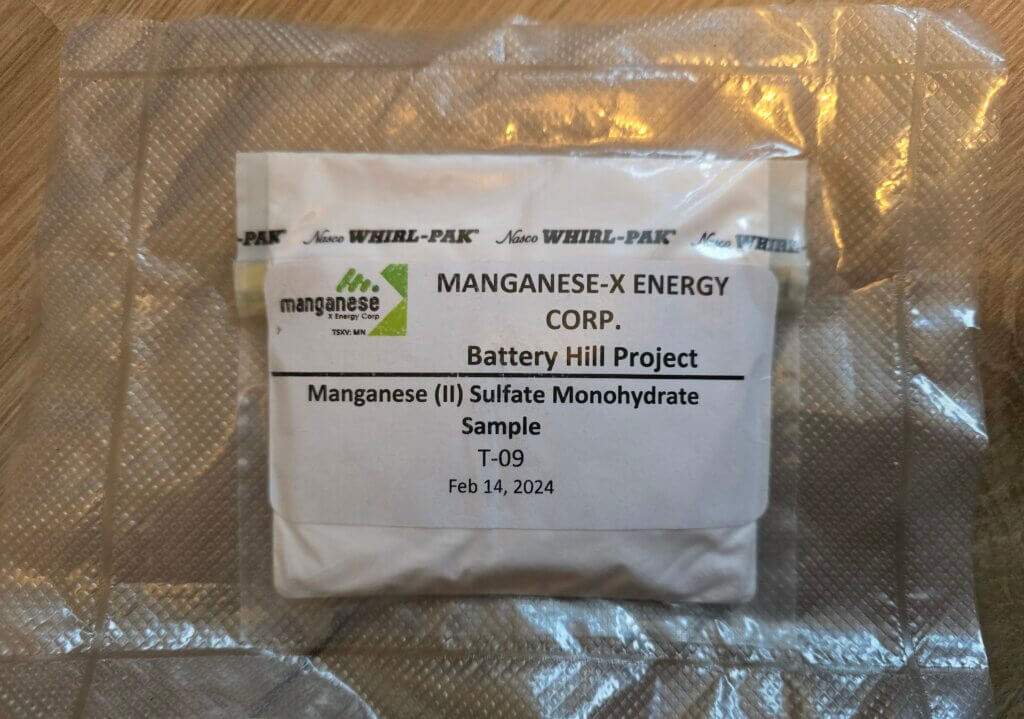

The types of mineral resources used vary by technology. Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance, longevity and energy density. Rare earth elements are essential for permanent magnets that are vital for wind turbines and EV motors. Electricity networks need a huge amount of copper and aluminium, with copper being a cornerstone for all electricity-related technologies.

The shift to a clean energy system is set to drive a huge increase in the requirements for these minerals, meaning that the energy sector is emerging as a major force in mineral markets. Until the mid-2010s, for most minerals, the energy sector represented a small part of total demand. However, as energy transitions gather pace, clean energy technologies are becoming the fastest-growing segment of demand. In a scenario that meets the Paris Agreement goals (as in the IEA Sustainable Development Scenario [SDS]), their share of total demand rises significantly over the next two decades to over 40% for copper and rare earth elements, 60-70% for nickel and cobalt, and almost 90% for lithium. EVs and battery storage have already displaced consumer electronics to become the largest consumer of lithium and are set to take over from stainless steel as the largest end user of nickel by 2040.

As countries accelerate their efforts to reduce emissions, they also need to make sure that energy systems remain resilient and secure. Today’s international energy security mechanisms are designed to provide insurance against the risks of disruptions or price spikes in hydrocarbons supply, oil in particular. Minerals offer a different and distinct set of challenges, but their rising importance in a decarbonising energy system requires energy policy makers to expand their horizons and consider potential new vulnerabilities. Concerns about price volatility and security of supply do not disappear in an electrified, renewables-rich energy system.

This is why the IEA is paying close attention to the issue of critical minerals and their role in energy transitions. This report reflects the IEA’s determination to stay ahead of the curve on all aspects of energy security in a fast-evolving energy world.

Our bottom-up assessment of energy policies in place or announced suggests that the world is currently on track for a doubling of overall mineral requirements for clean energy technologies by 2040 (in the IEA Stated Policies Scenario, STEPS).

However, a concerted effort to reach the goals of the Paris Agreement (climate stabilisation at “well below 2°C global temperature rise”, as in the SDS) would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today.