Mining the NEXT big metal in lithium-ion batteries

Once upon a time, when junior mining companies raised capital most of that money went into the ground. Times have changed. Today, most of the capital raised by junior miners is often eaten up in general administration costs.

Some mining companies, however, retain that “old-fashioned” approach to conserving shareholder capital. Manganese X Energy Corp. (TSX: V.MN, OTCQB: SNCGF, Forum) is one company who still believes that shareholder dollars are best spent in the ground. The Company preaches a team approach to management rather than an emphasis on individuals. This is reflected in the modest compensation packages, from CEO Martin Kepman on down the management ranks.

However, while the Company takes an old-fashioned approach to managing shareholder capital, everything else about Manganese X is strictly 21st century – starting with its business. As the name states, Manganese X Energy is focused on manganese production, in a global economy where manganese is emerging as a key next-generation metal in the production of hi-tech fuel cells.

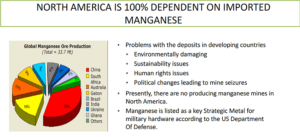

North American mining investors are likely not very familiar with manganese, in terms of its uses or the companies seeking to mine this metal. This is not surprising given that today there are no primary sources of manganese production anywhere in North America, despite the United States Department of Defense listing manganese as “a strategic metal”. Yet manganese is humanities 4th most-used metal, vital to industry, especially with respect to the steel industry.

Indeed, until very recently, roughly 90% of the manganese produced globally was funneled into the steel-making industry. We use (and need) a lot of steel: more than 1,600 million tonnes in 2016 alone. Manganese makes all of this steel better, and in a multitude of ways.

However, talking about manganese and steel is a very 20th century perspective on the manganese market. The management of Manganese X is much more centered on (and excited by) the potential of this metal in 21st century hi-tech applications. Here, conversation quickly switches from steel fabrication to battery-making – the hi-tech fuel cells which are becoming a focal point of both investors and industry.

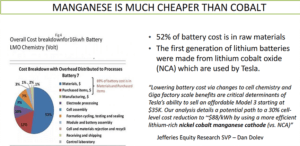

Lithium-ion batteries. By now, anyone paying attention to the evolution of the 21st century auto industry has that phrase on their lips. For some investors, their eyes are on the batteries themselves, and the manufactured products which require these hi-tech/high energy fuel cells. However, the majority of the cost in producing lithium-ion batteries is in the materials used in these batteries.

This is another way of saying that the largest component of revenues from the production of lithium-ion batteries will go to the companies which are mining these metals. This means that investors looking to capitalize on the explosion in the use of these fuel cells will find the greatest potential for profits by investing in the producers of these vital metals.

But in which metal should one invest?

As the technology advances, a number of metals are playing greater or lesser roles in the design and manufacturing of these fuel cells: nickel, aluminum, cobalt, manganese, and of course lithium itself. However, while lithium demand is soaring, lithium is an extremely abundant metal, where major producers still retain surplus capacity.

Nickel is another important metal in the production of lithium-ion batteries. But nickel inventories remain elevated and nickel prices remain soft. Even with its use in hi-tech batteries there are few signs that the nickel market is about to take off.

Cobalt is presently a vital metal in lithium-ion batteries, as well as many other industrial applications. However, unlike lithium, the problem with cobalt is not its abundance but rather its scarcity. Cobalt is rarely found in high concentrations. As a result, roughly 97% of global cobalt production comes as a byproduct of other metals mining, mostly copper and nickel.

What this means is that not only is cobalt scarce but it is an extremely inelastic market. Even if cobalt prices should soar, there can (and will) be only a muted response on the supply side. The ramifications here for battery-making are critical. As battery production increases, the capacity of the mining industry to meet soaring demand for cobalt is problematic, at best.

Enter manganese. Going back more than 20 years; scientists had already pioneered a lithium-ion battery which used manganese as one of the metals for the battery cathode. The cathode is the positive terminal of a battery through which the electric current flows out, and optimizing the composition of these battery cathodes is one of the key factors in maximizing battery performance.

As with most emerging technology, early-generation lithium-ion batteries were designed from whatever metals the pioneers in this research could use to produce functional fuel cells. With respect to lithium-ion batteries for the automotive market, the first battery-of-choice was a lithium-nickel-cobalt-aluminum design (NCA).

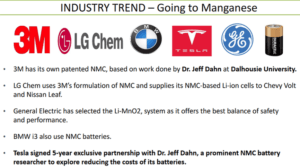

To simplify the chronology, the NCA cells were perceived to be less than optimal in a few respects, so researchers have been working on new-and-improved designs. The next version brought to market was a lithium-nickel-cobalt-manganese formulation (NCM). The NCM cells offered advantages over the NCA design, including superior efficiency.

However, even the NCM design has a couple of issues with which researchers are struggling to cope. Among the question-marks with NCM cells are that early versions were roughly a one-third/one-third/one-third mixture of nickel, cobalt, and manganese. This cell design would require even more cobalt than standard NCA cells, with the supply of cobalt (as already noted) highly problematic.

This means there is still a strong research and profit incentive to look for even better battery designs. A leading figure in this fuel cell research is Dr. Jeffrey Dahn, a Professor of Chemistry at Dalhousie University.

Tesla Motors and the National Sciences and Engineering Research Council (NSERC) have chosen Dahn as their Industrial Research Chair, with Dahn’s primary mission being to advance fuel cell research. Dahn is looking to design an NCM cell with a significantly lower cobalt percentage, making the long-term economics of this fuel cell much more practical.

However, this isn’t the only avenue of interest to metals investors in general, and manganese investors in particular. Yet another fuel cell has materialized in the world of battery research: a lithium-manganese dioxide formulation (LiMnO2), which (in its present design) is roughly 4% lithium, 61% manganese, and 31% oxygen.

The LiMnO2 cell boasts high power and low cost. It offers greater stability than the more-volatile NCA cell design, and requires no cobalt, making it more practical than either the NCA or NCM cell designs. The economics here are pretty simple.

Manganese is relatively cheap and plentiful. Perfecting a lithium-ion battery which uses manganese as a primary ingredient could literally be the key to making the Tesla electric vehicles truly cost-competitive. But investors calculating the potential of the manganese market cannot focus on the electric car market alone.

A second, vital, industrial application is emerging for lithium-ion fuel cells: energy storage. As the world moves to more renewable energy sources (i.e. wind and solar) a practical problem has emerged. “Green” power-generation from wind and solar power facilities is generated unevenly: there is lots of power generation for parts of the day; very little power generation during other parts of the day.

The necessity is for these green renewable energy sources to be able to store power during peak power generation hours, and then release that energy during lulls. As with the electric vehicle market, the economic viability of renewable power will be largely dependent on efficient energy storage – to maximize utilization of the power produced from these sources.

These are the 21st century hi-tech imperatives which Manganese X Energy is striving to address, as it seeks to become the first/only primary manganese mining operation in North America. In addressing this need, the Company was eager to find the right project for development.

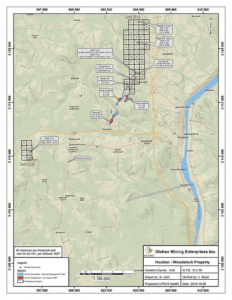

Management’s search led them to Globex Mining Enterprises Inc. and Jack Stoch. Globex Mining is an esteemed property management and project generator corporation. Stoch is an experienced geologist and well-known mining entrepreneur, and one of the land packages in Globex’s portfolio was a highly prospective manganese property in the Province of New Brunswick: Battery Hill.

The property consists of 56 claims totaling 896 hectares, and was the site of historic manganese mining in the 1800’s. As Stock laid out the potential of the Battery Hill Project, the management team at Manganese X knew that their search was over. A 2016 NI 43-101 report on Battery Hill reviewed and discussed current and historic surface work, along with previous drilling from 2011. Historical exploration on the site from the 1950’s indicated an Inferred resource of roughly 70 million tonnes, with average grades of approximately 9%. Mineralization remains open at depth, and five other manganese-rich zones have yet to be explored.

Geologically, the ore is present in the form of manganese carbonate. This form of manganese ore is particularly ‘friendly’ from a metallurgical standpoint, as the manganese can be extracted using a simple heap leach process.

The Company is confident they are looking to produce the right metal at the right project. However, one task remains for management: developing the right process with which to extract all of these manganese riches.

Conventional manganese mining typically employs large volumes of sulfuric acid in the extraction process. Two issues present themselves with respect to conventional manganese mining. Sulfuric acid is a very expensive input to use in manganese extraction, and (not surprisingly) the use of large quantities of this highly corrosive acid presents environmental problems.

As Manganese X looks to move Battery Hill toward production, the Company is dedicating itself to engineering a cheaper and greener process to bring this 21st metal to a North American market starved of manganese production. Concurrently, management is embarking on research to produce its metal in a form most-conducive to 21st century applications: electrolytic manganese dioxide (EMD).

Manganese X is positioning itself to be the only pure-play producer of EMD. Kingston Process Metallurgy is leading the research here, with an EMD Concept Study already planned.

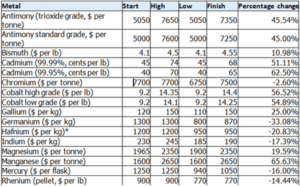

Between January 1, 2016 and December 31, 2016, according to Metalbulletin.com, manganese appreciated in value more than 65 percent in 2016 to an average of $2,350 per tonne within the minor metals leaderboard category. Manganese ranked second in appreciation in a broad list to include the other components associated with the lithium ion battery.

The Company’s management team is lean but experienced. CEO Martin Kepman is a business development specialist. The founder of Martin Kepman and Associates Inc, the company is a business development and management consulting firm, with roughly 35 years of experience, and which has serviced industries ranging from software to mining.

Manganese X’s VP of Exploration is Roger Dahn. Dahn is a veteran geologist with more than 30 years of mining and exploration experience. Sixteen of those years were spent with Noranda Inc and Hemlo Gold Mines Inc. He has also held senior positions with Battle Mountain Gold, Olympus Pacific Minerals, and Tri-Star Resources.

CFO Jacques Arsenault has more than 20 years of expertise in corporate development, restructuring, acquisitions, mergers, and sales. Since 2006; he has served as CFO for two other resource companies. Prior to that, he spent several years as a financial controller for several corporations.

Manganese X Energy was formerly known as Sunset Cove Mining. As the Company reorganized its business to launch itself into manganese mining, it has received invaluable support from Todd Anthony and First Republic Finance. First Republic provided the funding to help Manganese X to complete its corporate reorganization, and stands ready to backstop the Company financially as it works to move Battery Hill to production.

Manganese has not previously been in the vocabulary of North American mining investors. As Manganese X Energy seeks to bring mining of this 21st century metal to this continent, it’s time for investors to update that vocabulary. Further information can be found here.

View the original article here

About Manganese X Energy

Manganese’s X mission is to acquire and advance high potential manganese mining prospects located in North America with the intent of supplying value added materials to the lithium ion battery and other alternative energy industries. In addition our company is striving to achieve new methodologies emanating from environmentally and geographically ethical and friendly green/zero emissions technologies, while processing manganese at a lower competitive cost.

For more information, visit the website at www.manganesexenergycorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Martin Kepman

CEO and Director

martin@kepman.com

1-514-802-1814

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking information” including statements with respect to the future exploration performance of the Company. This forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements of the Company, expressed or implied by such forward-looking statements. These risks, as well as others, are disclosed within the Company’s filing on SEDAR, which investors are encouraged to review prior to any transaction involving the securities of the Company. Forward-looking information contained herein is provided as of the date of this news release and the Company disclaims any obligation, other than as required by law, to update any forward-looking information for any reason. There can be no assurance that forward-looking information will prove to be accurate and the reader is cautioned not to place undue reliance on such forward-looking information. We seek safe harbor.